Rocky View County tax rates are set annually by Council.

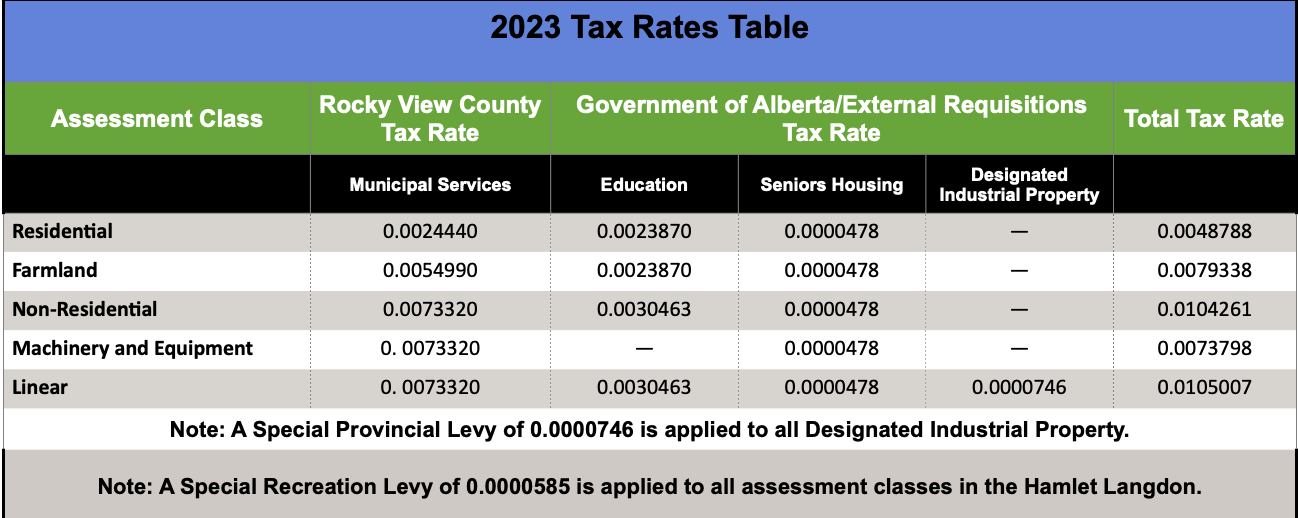

Above: 2023 property tax rates (formula explained below). Click to enlarge (PDF).

Council sets the tax rates based on the amount of property tax revenue that is required to pay for the services provided by the County.

Individual property assessment and taxes usually change each year due to the requirements of the annual budget, and year-to-year changes in property value.

Rocky View County is required to collect additional education, seniors’ lodging and Designated Industrial Property (DIP) tax on behalf of the Province of Alberta.

Property Tax Formula

County property taxes are calculated based on the application of the following formula:

Assessed Value x Residential Tax Rate

Example

If the assessed value of a residential property is $950,000, and the residential tax rate for the year is 0.0050773, the estimated taxes on that property are:

$950,000 x 0.0050773 = $4,819.64